-

How AI Tools Are Revolutionizing Research in 2025

By SciRev Editorial In today’s fast-paced academic world, Artificial Intelligence (AI) has become more than a buzzword — it’s transforming…

-

CiprofloxacinElectrochemicalSensorUsingCopper−IronMixedMetalOxidesNanoparticles/ReducedGrapheneOxideComposite

JedsadaChuiprasert, SiraSrinives,NarinBoontanon,ChongrakPolprasert,NudjarinRamungul, ApisitKarawek, andSuwannaKitpatiBoontanon ABSTRACT: The harmful effects of antibiotic proliferation on the environment and its persistant nature are urgent…

-

Rapid fabrication of MgO@g-C3N4 heterojunctions for photocatalytic nitric oxide removal

Authors Minh-Thuan Pham1,2,3, Duyen P. H. Tran1,2,3, Xuan-Thanh Bui4 and Sheng-Jie You*2,3 Abstract Nitric oxide (NO) is an air pollutant…

-

Global Economic Outlook May 2025: Trade Tensions, Oil Prices, and Currency Volatility

Trade Tensions Shake Global Markets In May 2025, the global economic landscape is being reshaped by aggressive U.S. trade policies…

-

Australia Votes 2025: Labor Secures Historic Second Term Amid Liberal Collapse

Australia’s 2025 federal election, held on May 3, delivered a decisive and historic win for the Labor Party, led by…

-

Cancer vaccines, potentially revolutionizing global cancer treatment

#Russian President Vladimir #Putin recently announced significant progress towards developing cancer vaccines, potentially revolutionizing global cancer treatment. Putin shared this…

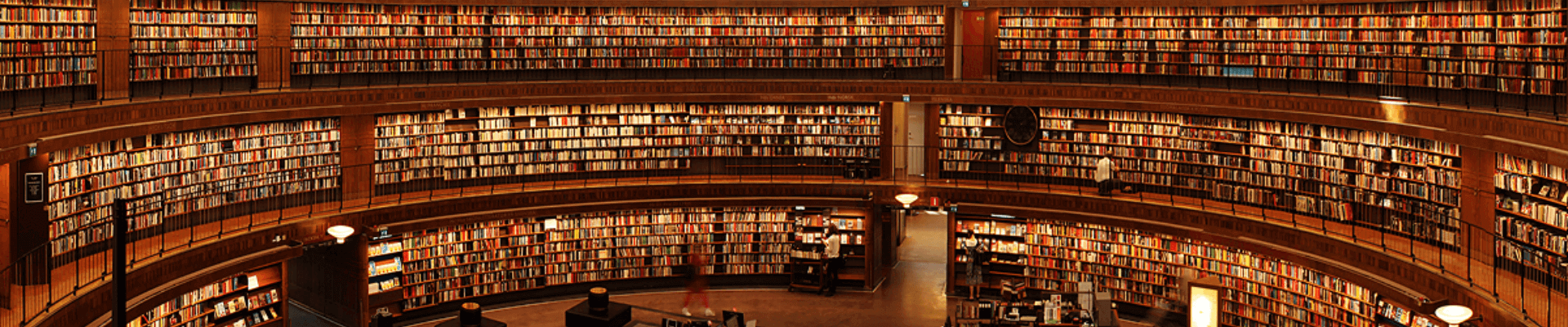

New Arrivals: Explore the latest books & journals now available in our collection!